WYLD, a social currency payment card launches in India

By Leandra Monteiro

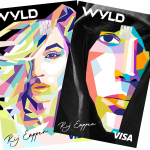

WYLD, a social currency payment card has launched in Mumbai. Powered by Visa, the platform will allow everyday social media users to leverage their Instagram to earn massive cashback on daily spending.

WYLD, a social currency payment card has launched in Mumbai. Powered by Visa, the platform will allow everyday social media users to leverage their Instagram to earn massive cashback on daily spending.

The platform is currently invite-only, and open to the first 5,000 users on their waitlist of 10,000 potential customers, for their beta-testing phase.

Speaking on the occasion, Rij Eappen, Co-founder & COO said, “We are thrilled to officially launch our platform, and open it up to our users in Mumbai to begin with. We aim to disrupt the space by essentially digitising ‘word-of-mouth’ marketing. The paradox is that while everyone on social media has influence in varying degrees, the market is currently focussed on the 1% with large following, despite nano-influencers having a higher, more organic engagement rate. Today’s social media users largely consist of young millennials and Gen Z who are extremely savvy, socially active, and are always on the lookout for deals and pocket-friendly methods of upgrading their lifestyle, and WYLD helps them achieve this.”

Conceived in 2021, WYLD is a FinTech and Martech mobile app and payment card. The app lets anyone with over 1000 followers on Instagram and a ‘WYLD Score’ of over 100, apply for the WYLD payment card. The WYLD Score is determined through an algorithm that analyses a user’s social media usage – their followers, reach, frequency of posts and stories, and the engagement on these posts by their followers.

Users have to make purchases using the WYLD card, post about their purchase on Instagram, and earn massive cashback, ranging from 30 -100% of their transaction value, back into their card wallet, the cashback percentage determined by the person’s WYLD Score. The company has already partnered with over 200 brands across several verticals like Social, Smoke House Deli, Boat, Lenskart, Purplle etc.

IBSi Daily News Analysis

January 16, 2024

Card Payments

Egypt among top remittance recipient countries in 2023: World Bank

Read MoreIBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related News

Related Reports

Sales League Table Report 2023

Know More

Global Digital Banking Vendor & Landscape Report Q4 2023

Know More

Wealth Management & Private Banking Systems Report Q4 2023

Know More

IBSi Spectrum Report: Supply Chain Finance Platforms Q4 2023

Know More