Key Market Trends in Global Banking Technology

By Puja Sharma

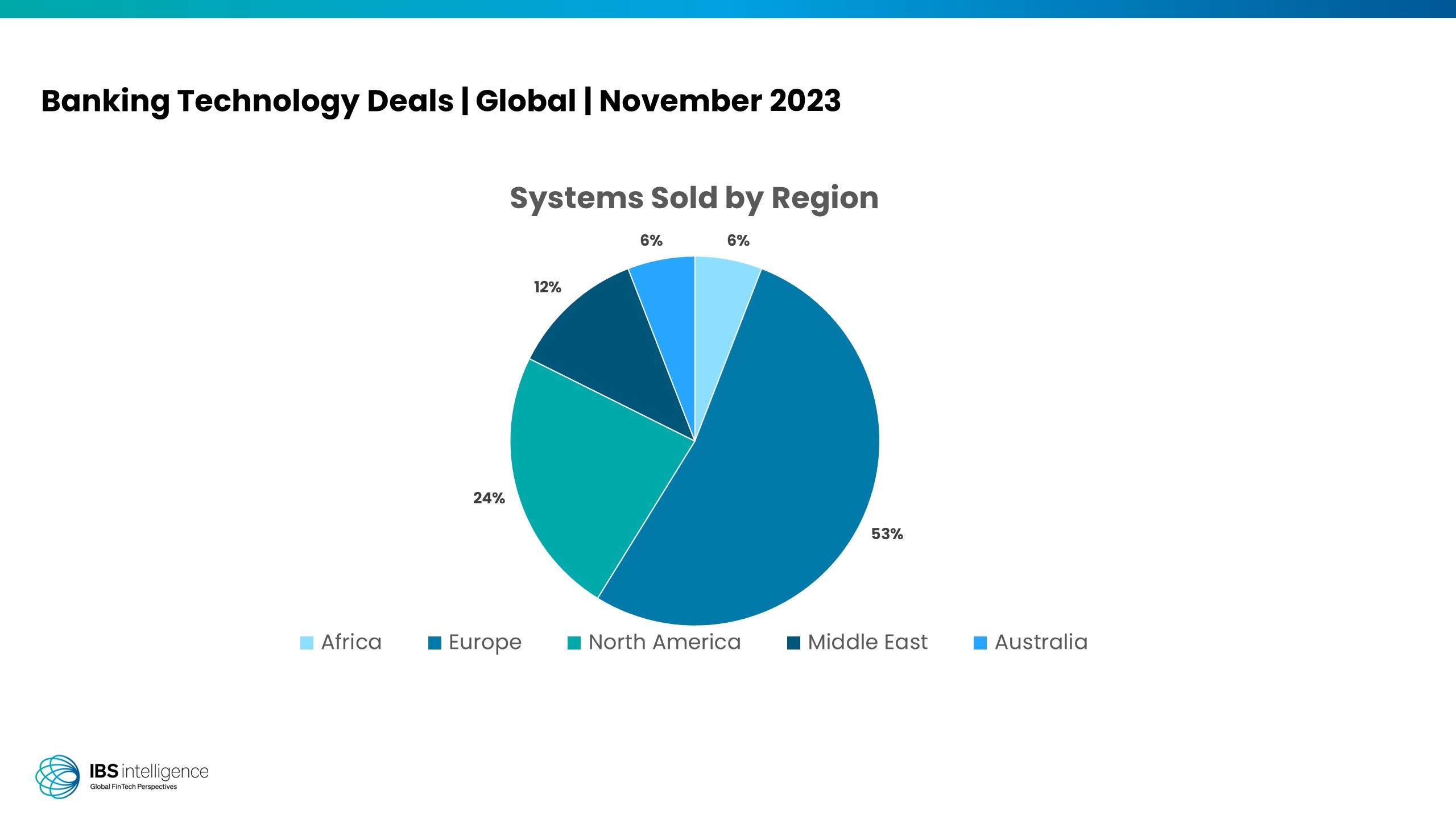

The distribution of global banking technology deals recorded by IBS Intelligence in November 2023 reveals distinct trends in regional preferences and the types of systems sold. Europe’s dominance, with 53% of systems sold, can be attributed to the region’s advanced financial infrastructure and the ongoing efforts by European banks to modernize their systems. North America and MENA’s substantial shares at 24% and 12%, respectively, reflect continuous tech adoption in these regions, driven by the need for innovation and regulatory compliance.

The distribution of global banking technology deals recorded by IBS Intelligence in November 2023 reveals distinct trends in regional preferences and the types of systems sold. Europe’s dominance, with 53% of systems sold, can be attributed to the region’s advanced financial infrastructure and the ongoing efforts by European banks to modernize their systems. North America and MENA’s substantial shares at 24% and 12%, respectively, reflect continuous tech adoption in these regions, driven by the need for innovation and regulatory compliance.

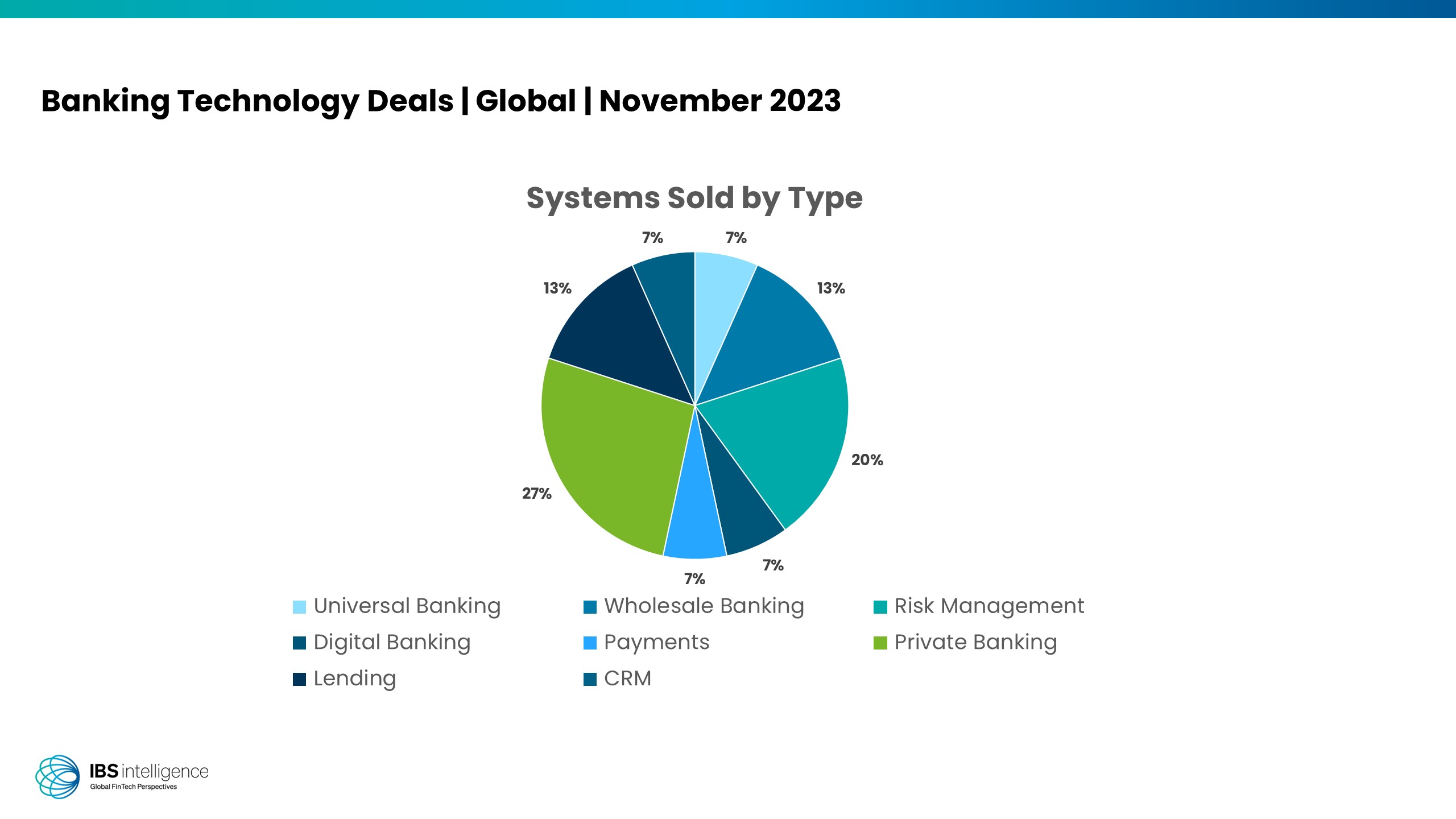

Private banking, the highest-selling systems globally at 27%, reflects a growing focus on personalized financial services and Wealth Management. The demand for Risk Management systems (20%) underscores the industry’s increasing Cybersecurity and risk mitigation awareness. Lending and wholesale banking systems (13%) are catching up globally due to the emphasis on credit management and corporate financial services.

The convergence of payments, Universal Banking, Digital Banking, and CRM systems at 7% suggests a broader industry shift towards comprehensive, integrated solutions. Financial institutions recognize the importance of a unified customer experience, driving the adoption of digital banking and CRM systems. The growth in universal banking and payment systems reflects a holistic approach to financial services, meeting diverse customer needs.

In summary, the trends in global banking technology deals in November 2023 highlight the continued emphasis on modernization, risk management, and personalized financial services. Europe’s leadership in system acquisitions aligns with its robust financial ecosystem, while the global surge in private banking systems reflects a broader industry focus on tailored wealth management. The adoption of comprehensive solutions and the rise of lending and wholesale banking systems indicate an industry-wide push towards integrated, versatile banking technology.

The banking technology deal chart compiled by IBS Intelligence provides crucial insights into the global landscape of banking technology transactions. This chart and the analysis that may be derived from it provide industry professionals with key actionable information about where to deploy their resources:

- Strategic Decision-Making: For executives and decision-makers in the banking industry, understanding the distribution of technology deals is vital for making informed strategic decisions. This information allows them to align their technological investments with regional trends, ensuring they stay competitive in their respective markets.

- Market Trends and Opportunities: The chart helps industry professionals identify emerging trends and opportunities in the global banking technology sector. For instance, the dominance of Europe in technology deals highlights the region’s commitment to modernization, presenting potential opportunities for vendors and investors to explore this market further.

- Regional Variations: Understanding the regional distribution of technology deals is crucial for multinational financial institutions and technology providers. It provides insights into different regions’ unique challenges and preferences, helping them tailor their solutions to meet specific market needs.

- Innovation and Regulatory Compliance: The substantial market shares of North America and MENA indicate a strong focus on innovation and regulatory compliance in these regions. Banking professionals need to be aware of these trends to ensure that their organizations keep pace with technological advancements and continue to meet regulatory requirements.

- Investment and Partnership Opportunities: Investors and potential business partners can use the information in the chart to identify regions and sectors with high technology adoption rates. This insight can guide investment decisions and foster collaborations that capitalize on the growing demand for banking technology.

IBSi Daily News Analysis

January 16, 2024

API Banking

Egypt among top remittance recipient countries in 2023: World Bank

Read MoreIBSi FinTech Journal

- Most trusted FinTech journal since 1991

- Digital monthly issue

- 60+ pages of research, analysis, interviews, opinions, and rankings

- Global coverage

Other Related News

Today

Surge in digital identity fraud is a major problem for financial services, research reveals

Read MoreRelated Reports

Sales League Table Report 2023

Know More

Global Digital Banking Vendor & Landscape Report Q4 2023

Know More

Wealth Management & Private Banking Systems Report Q4 2023

Know More

IBSi Spectrum Report: Supply Chain Finance Platforms Q4 2023

Know More